Self-storage REITs (real estate investment trusts) own, operate, and manage mini-warehouse storage facilities. These properties enable businesses and individuals to securely store items in individual storage units.

Here's a closer look at the self-storage REIT business. We will explore its advantages and risks and some leading self-storage REITs that investors should consider.

Understanding self-storage REITs

Understanding self-storage REITs

Self-storage properties are small warehouses with multiple units that range in size. Owners lease storage units in these buildings to businesses and individuals that need space to store inventory or household items. Some self-storage operators will also rent parking spaces to store boats, RVs, and other vehicles.

Most self-storage units rent on a month-to-month basis. That differs from the lease structure of many other REITs, which typically own properties that lease space for a year or more. On the one hand, the shorter-term lease structure enables self-storage REITs to raise rents more frequently to market rates. On the other hand, they might have to reduce rents during a down market.

In addition to generating rental income, self-storage REITs have several other potential revenue sources, depending on their business model. These can include tenant reinsurance income, late fees, management fees, and the sale of moving materials (boxes, packaging, tape, etc.).

Advantages

Advantages of investing in self-storage REITs

Self-storage REITs benefit from steadily rising demand for storage space. The sector's demand drivers include relocation, decluttering, disasters, changing life circumstances, and business purposes. These factors tend to keep occupancy levels high while steadily pushing rental rates higher.

Self-storage properties are also one of the lowest-cost real estate investments since they're typically inexpensive to build and operate. As a result, they tend to have relatively low occupancy break-even rates. These factors enable self-storage investments to generate high margins and investment returns.

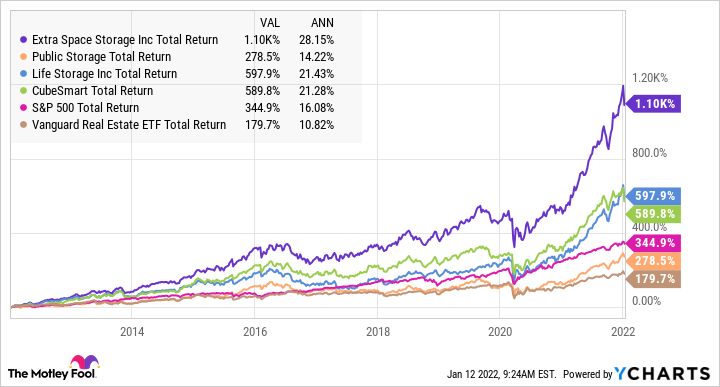

Because of that, self-storage REITs have historically been among the best-performing investments in the REIT sector. Self-storage REITs have significantly outperformed other real estate investments over the past decade, including leading REIT ETF Vanguard Real Estate ETF (VNQ 1.21%), with most also delivering market-beating total returns.

Risks

Risks of investing in self-storage REITs

While self-storage REITs have been excellent long-term investments, they're not without risk. There are two notable sector-specific risks:

- Oversupply risk: Because self-storage facilities are cheap to build and operate, there are low barriers to entry. Developers can quickly build new capacity, which can increase competition for customers in a market, weighing on occupancy levels and rental rates at existing facilities.

- Economic risk: Due to the short-term nature of self-storage leases, the sector has more exposure to an economic downturn. If the economy takes a hit, fewer people will move. Businesses might also cut back expenses, impacting occupancy and rental rates.

In addition to those sector-specific risks, self-storage REITs face two intertwined potential headwinds common to the entire REIT sector: interest rate risk and financing risk.

As interest rates rise, borrowing money becomes more expensive. If a REIT has lots of floating rate debt or near-term maturities, rising rates can increase its interest expenses. Higher interest rates can also impact a REIT's ability to finance acquisitions and development projects.

Meanwhile, rising interest rates tend to weigh on REIT stock prices. That's because it makes lower-risk alternatives such as bonds more attractive investments since their income yields rise. As a result, REIT stock prices tend to fall, pushing up their dividend yields to compensate investors for their higher risk levels.

3 best self-storage REITs

3 best self-storage REITs to buy right now

There were six publicly traded self-storage REITs entering 2022. While all focus on owning, operating, and managing self-storage facilities, three of them stand out for their slightly differentiated business models.

| Self-Storage REITs | Ticker Symbol | Market Cap | Description |

|---|---|---|---|

| Public Storage | (NYSE:PSA) | $49.8 billion | The industry's leading owner, operator, and developer of self-storage facilities. |

| Extra Space Storage | (NYSE:EXR) | $31.6 billion | The second-largest owner of self-storage stores in the U.S. and the largest self-storage management company. |

| National Storage Affiliates | (NYSE:NSA) | $4.7 billion | A leading self-storage operator with a unique Participating Regional Operators (PROs) business model. |

Here's a closer look at what makes these self-storage REITs different from their competitors.

1. Public Storage

Public Storage is the largest self-storage REIT. It began 2022 with more than 2,700 properties and more than 198 million square feet of rentable space. In addition to those self-storage investments, it also owns a 35% interest in European self-storage REIT Shurgard Self Storage and a 42% interest in industrial REIT PS Business Parks (NYSE:PSB).

What differentiates Public Storage from its self-storage REIT peers is its property development platform. It's the only REIT that develops new properties; the rest primarily expand by acquisition. The company's development strategy has enabled Public Storage to earn higher investment returns compared to acquisitions over the years.

2. Extra Space Storage

Extra Space Storage is a leading self-storage REIT. It entered 2022 with more than 2,000 properties, 47% of which were wholly owned, 13% owned with joint-venture partners, and 40% managed.

Extra Space Storage's third-party management business sets it apart from other self-storage REITs. While most REIT rivals also manage properties owned by third parties, Extra Space Storage was an early leader in this business model. It currently manages more properties than any of its competitors.

This strategy has several benefits. It generates steady management fee income and requires little up-front investment. Meanwhile, it provides the company with a steady stream of acquisition opportunities. Extra Space Storage can purchase a property it knows very well when the owner sells, thereby reducing risk.

3. National Storage Affiliates

National Storage Affiliates is one of the smallest publicly traded self-storage REITs. It ended 2021 by achieving a milestone of having 1,000 locations.

What's unique about National Storage Affiliates is that it doesn't consolidate its properties under one national brand. Instead, it owns, operates, and manages strong regional brands. It had a dozen brands as of early 2022, including two corporate brands and 10 Participating Regional Operators (PROs).

National Storage Affiliates' PRO structure incentivizes private self-storage operators to come under its umbrella. The REIT benefits from being able to expand its portfolio while PROs absorb more of the downside risk. Meanwhile, PROs benefit from the scale of a larger company, the ability to maintain management, and to participate in the upside. PROs can eventually sell their business to National Storage Affiliates.

Related investing topics

Self-storage REITs have historically been great investments

Self-storage REITs benefit from a combination of lower costs, high demand, and short-term lease structures, which has enabled the sector to steadily increase income. That has helped the industry generate above-average total returns over the years. The ability to earn high returns makes self-storage REITs attractive options that real estate investors should closely consider.

Matthew DiLallo has positions in Public Storage. The Motley Fool has positions in and recommends Vanguard Specialized Funds - Vanguard Real Estate ETF. The Motley Fool recommends Extra Space Storage. The Motley Fool has a disclosure policy.